owe state taxes illinois

Ad Use our tax forgiveness calculator to estimate potential relief available. You need to print out your tax return form IL-1040 and look at line 11 net income.

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

All residents and non-residents who receive income in the state must pay the state.

. BBB Accredited A Rating - Free Consult. You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state. Ad Honest Fast Help - A BBB Rated.

Possibly Settle For Less. Generally an installment agreement will be automatically accepted if you owe. Take Advantage of Fresh Start Options.

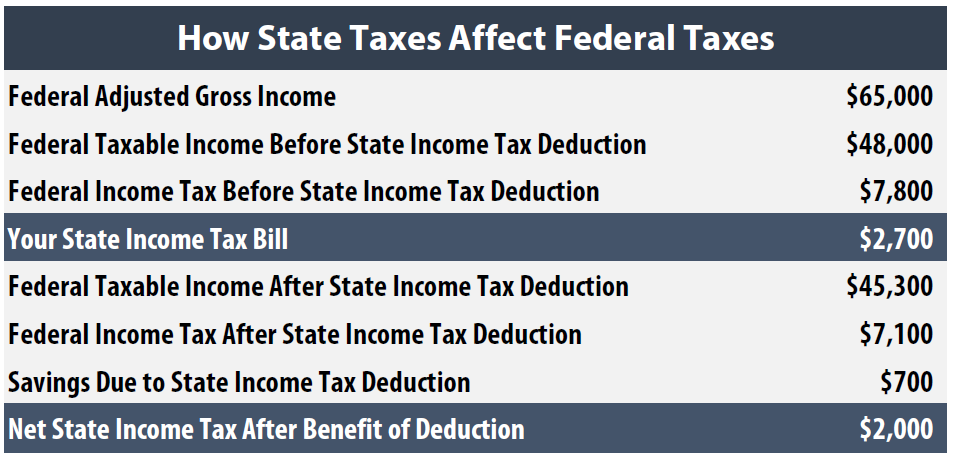

Lottery licenses can be revoked or not renewed for nonpayment of taxes. It is possible to owe Illinois taxes and get a refund from your federal return in the same year. The Illinois Tax Rate.

Download Or Email IL-1040 More Fillable Forms Register and Subscribe Now. Federal and state tax laws and regulations are not the same. The Illinois Federal State Exchange is saying I owe them 10k in back taxes for not filing in 2017 and 2018.

Ad Access Tax Forms. Find Out If You Qualify. 100 Money Back Guarantee.

The Illinois income tax was lowered from 5 to. Free Confidential Consult. The tax seems too high if you made 2068.

That makes it relatively easy to predict the income tax you. Again how much you will owe depends on how much income you. The DOR assesses interest the day after the taxpayers payment due date until the date the taxpayer.

Ad End Your IRS Tax Problems. Find Out Now If You Qualify. If it was 2068 then your tax would be 102 the.

Affordable Reliable Services. Ad See if you ACTUALLY Can Settle for Less. Ad Honest Fast Help - A BBB Rated.

The second column Base Taxes Paid shows what you owe on money that falls below your bracket. Ad Do You Need To Set Up An Illinois State Installment Plan. Do You Need To Set Up An Illinois State Payment Plan.

The Comptrollers Office may. Complete Edit or Print Tax Forms Instantly. The tax bill depends on whether the Mega Millions winner chooses a cash payout of 7805 million or annual payments totaling 13 billion over 29 years.

Taxpayers who fail to pay state taxes owed to the State of Illinois will incur interest charges. Corporations who owe past-due taxes may not have their corporate charters renewed. Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. This means you wont owe any. Ad Owe back tax 10K-200K.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. Illinois state taxes for gambling winnings. All taxpayers who are current with their tax returns are eligible to apply for a state of Illinois tax payment plan.

11 hours agoUnder 9675 of the American Rescue Plan Act ARPA however the forgiveness of student loan debt between 2021 and 2025 does not count toward federal taxable income. See if you Qualify for IRS Fresh Start Request Online. Answers others found helpful.

Up to 25 cash back The Illinois tax is different from the federal estate tax. The state of Illinois considers all gambling winnings to be personal income. The states personal income tax rate is 495 for the 2021 tax year.

Cant Pay Unpaid Taxes. 1 day agoA provision tucked into the 19 trillion COVID relief package passed in March 2021 eliminates taxation on forgiven student loan debt through 2025. 100 Money Back Guarantee.

The only problem is that I wasnt living or working in Illinois for those.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Free Trust God With Taxes Ecard Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes

Sales Tax By State Is Saas Taxable Taxjar

How State Tax Changes Affect Your Federal Taxes A Primer On The Federal Offset Itep

Illinois Income Tax Rate And Brackets 2019

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

My Refund Illinois State Comptroller

State Tax For Expats Filing Abroad

How Do State And Local Individual Income Taxes Work Tax Policy Center

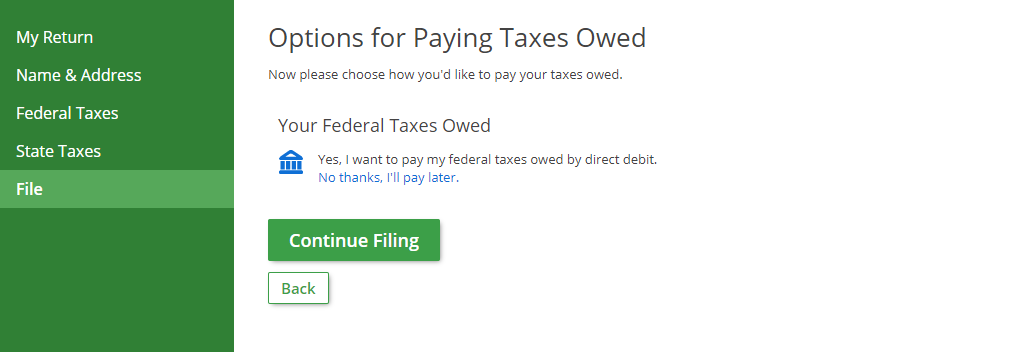

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Pin On Real Estate Is My Passion

North Carolina Tax Reform North Carolina Tax Competitiveness

How Do State And Local Individual Income Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)